what is fit tax on paycheck

This is known as your withholding tax a partial payment of your annual income taxes that gets sent directly to the government. Divide the sum of all taxes by your gross pay.

2015 W2 Form Free New Easy To Use Accounting Software For Small Businesses Payroll Software W2 Forms Accounting Software

All other individuals who do not fit these.

. However payroll software will. Now is the easiest time to switch your payroll service. Employers send federal tax withholdings straight to the federal government.

Calculate Federal Income Tax FIT Withholding Amount. How You Can Affect Your Arkansas Paycheck. A financial advisor in Arkansas can help you understand how taxes fit into your overall financial goals.

With information from Form W-4 and some tax tables you can calculate how much tax to withhold. The federal government is entitled to a portion of your income from every paycheck. Arkansas residents can tweak their paychecks in a few ways.

Your employer uses several pieces of information to calculate your estimated federal tax liability. If youd prefer more money per paycheck claim a greater number of dependents. Free for personal use.

You can fill out a new W-4 or you can have a dollar amount withheld from every paycheck by entering that amount on the correct line on your W-4. Calculate Federal Insurance Contribution Act FICA taxes using this years Medicare. To calculate Federal Income Tax withholding you will need.

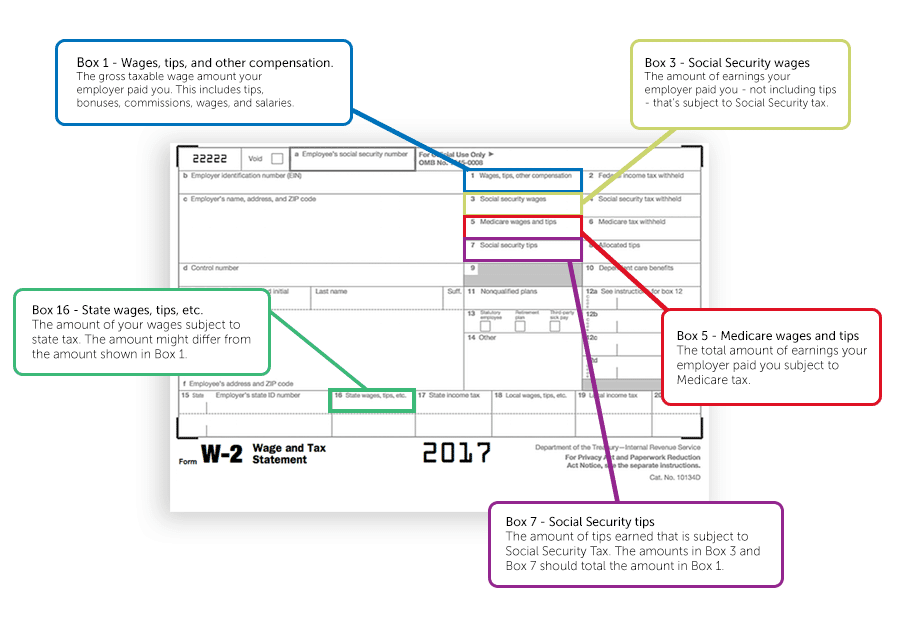

The amount of FIT withholding will vary from employee to employee. How You Can Affect Your Indiana Paycheck. At tax time your employees withholding will show on their Form W-2.

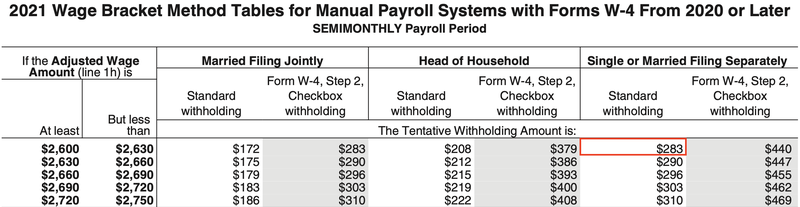

Withholding calculators tax calculators payroll information and more. For example a single employee making 500 per weekly paycheck may have 27 in federal income tax withheld per paycheck in 2021 if the employer uses the wage bracket method for standard withholding. Determine if state income tax and local income tax apply.

The employees adjusted gross pay for the pay period. These steps will. Make sure you have the table for the correct year.

Review current tax brackets to calculate federal income tax. The amount depends on several factors including payment amount and the number of dependents. Take these steps to determine how much tax is taken out of a paycheck.

If you want a bigger income tax refund reduce the number of dependents you claim. The employees W-4 form and. The following taxes and deductions are what you can expect to see on your paycheck explained in detail below.

Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. If you received a large tax refund or were hit with a massive tax bill when you last filed your income taxes consider changing your withholdings on your W-4. A copy of the tax tables from the IRS in Publication 15.

Federal Income Tax FIT Unless exempt all employees will need to have federal income tax withheld from their paycheck.

Blue Summit Supplies Tax Forms 1099 Misc 5 Part Tax Forms Kit 100 Count Security Envelopes Small Business Accounting Software Business Accounting Software

2020 1099 Misc Irs Copy A Form Print Template Pdf Fillable Etsy Print Buttons Print Templates Templates

China Certificate Of Origin Cfc Within Certificate Of With Regard To Certificate Of Origin For A Vehi Certificate Of Origin Certificate Certificate Templates

Great Budget Spreadsheet Budget Spreadsheet Monthly Expense Calculator Budgeting

2015 W2 Form Free New Easy To Use Accounting Software For Small Businesses Payroll Software W2 Forms Accounting Software

Bi Weekly Budget Spreadsheet Paycheck To Paycheck Budget Etsy Video Video Budget Spreadsheet Budgeting Monthly Budget Template

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

What Is A W 2 Form Irs Tax Forms Tax Forms W2 Forms

Supplemental Pay 2 Ways For Withholding Income Taxes

Non Profit Treasurer Report Template Inspirational Free Excel Treasurer Report Template Capable Problem Report Template Templates Non Profit

Service Invoice Template Invoice Template Word Invoice Template Freelance Invoice Template

Mileage Tracker Printable Business Mileage Log Business Etsy In 2022 Mileage Tracker Printable Mileage Tracker Business Tax

2015 W2 Form Free New Easy To Use Accounting Software For Small Businesses Payroll Software W2 Forms Accounting Software

What Is A W 2 Form Irs Tax Forms Tax Forms W2 Forms

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats And What I Payroll Template Good Essay Templates

Paycheck Budgeting Bill Planner Organize Finances Checkbook Register Finance Organization Organization Printables

Keep Track Of Your Subscriptions And Memberships With This Accessible Template Record The Date Amount Paid Length And Expi Planner Subscription Tracker Free

Understanding Your Paycheck Paycheck Understanding Yourself Understanding