pinellas county sales tax calculator

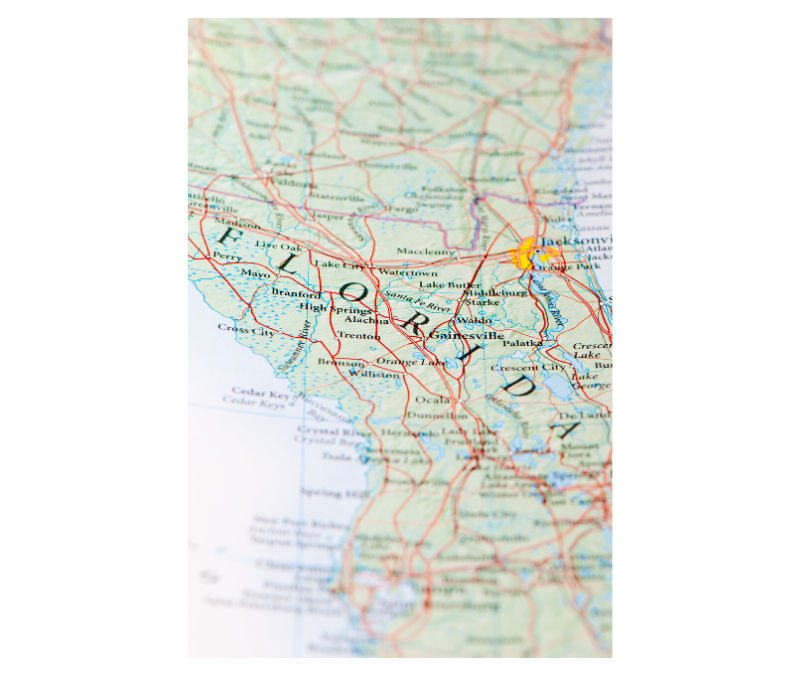

All applications for title must be signed with the applicants full name. Floridas general state sales tax rate is 6 with the following exceptions.

Florida Income Tax Calculator Smartasset

Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

. The state of Florida imposes 6 sales tax on the full purchase price less trade-in. 2020 rates included for use while preparing your income tax deduction. This rate includes any state county city and local sales taxes.

The Pinellas County Sales Tax is collected by the merchant on all qualifying sales made within Pinellas County. Taxable Value x Millage Rate 1000 Gross taxes On January 29 2008 Florida voters approved an additional 25000 homestead exemption to be applied to the value between 50000 and 75000. Florida has a 6 sales tax and Pinellas County collects an additional 1 so the minimum sales tax rate in Pinellas County is 7 not including any city or special district taxes.

JustMarket Value limited by the Save Our Homes Cap or 10 Cap Assessed Value. 4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity. The Florida state sales tax rate is currently.

The sales are held in accordance with Florida Statutes Chapter 197 and Florida Administrative Code Chapter 12D-13. The latest sales tax rate for Madeira Beach FL. Percent of income to taxes 24.

This table shows the total sales tax rates for all cities and towns in Pinellas County. Sales Tax 1151. The latest sales tax rate for Tierra Verde FL.

2020 rates included for use while preparing your income tax deduction. The median property tax on a 18570000 house is 194985 in the United States. Local tax rates in Florida range from 0 to 2 making the sales tax range in Florida 6 to 8.

Florida sales tax details. If this rate has been updated locally please contact us and we will update the sales tax rate for Pinellas County Florida. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

This rate includes any state county city and local sales taxes. For Tax Certificate Sales please visit the Pinellas County Tax Collector. 2020 rates included for use while preparing your income tax deduction.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. You can find more tax rates and allowances for Pinellas County and Florida in the 2022 Florida Tax Tables. Pinellas County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Pinellas County totaling 1.

Ad Find Out Sales Tax Rates For Free. 2020 rates included for use while preparing your income tax deduction. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Pinellas County.

The latest sales tax rate for Gulfport FL. Depending on city county and local tax jurisdictions the total rate can be as high as 8. The Florida FL state sales tax rate is currently 6.

The December 2020 total local sales tax rate was also 7000. Find your Florida combined state and local tax rate. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

Clerks Official Records conducts the sale of Tax Deeds in Pinellas County upon notification from the Pinellas County Tax Collector. This is the total of state and county sales tax rates. This rate includes any state county city and local sales taxes.

Total Estimated Tax Burden 13635. The latest sales tax rate for Belleair Bluffs FL. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

The 2018 United States Supreme Court decision in South Dakota v. This rate includes any state county city and local sales taxes. The minimum combined 2022 sales tax rate for Pinellas County Florida is.

3 Oversee property tax administration. Fast Easy Tax Solutions. Pinellas County residents pay an additional 1 on the first 5000.

The current total local sales tax rate in Pinellas County FL is 7000. Pinellas County Florida - Resident information - taxes and budget. Actual property tax assessments depend on a number of variables.

In the state of Florida all sellers of tangible property or goods including leases licenses and rentals are required to register with the state and file and pay sales tax. The base state sales tax rate in Florida is 6. Florida sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

The Pinellas County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Pinellas County local sales taxesThe local sales tax consists of a 100 county sales tax. The total sales tax rate in any given location can be broken down into state county city and special district rates. Created with Highcharts 607.

Assessed Value - Exemptions Taxable Value. Your household income location filing status and number of. The sales tax rate for Pinellas County was updated for the 2020 tax year this is the current sales tax rate we are using in the Pinellas County Florida Sales Tax Comparison Calculator for 202223.

The Pinellas County sales tax rate is. The estimated cost to register and title a vehicle for the first time is 42000 plus any sales tax due.

Fast Facts What You Should Know About Real Property Tax

Florida Reduces Sales Tax Rate On Commercial Leases Mobiliti Cre

Florida Sales Tax Calculator Reverse Sales Dremployee

Florida Sales Tax Calculation By Zip Code For Dr 15 Spreadsheet By Resellingsolutions Ebay Templates Etsy Sales Filing Taxes

Florida Car Sales Tax Everything You Need To Know

Florida Vehicle Sales Tax Fees Calculator

Florida Vehicle Sales Tax Fees Calculator

How To Find Tax Delinquent Properties In Your Area Rethority

2021 Florida Sales Tax Rates For Commercial Tenants Winderweedle Haines Ward Woodman P A

Florida Property Tax H R Block

Florida Vehicle Sales Tax Fees Calculator

Florida Sales Tax Guide And Calculator 2022 Taxjar

Florida Sales Tax Rates By City County 2022

Florida Vehicle Sales Tax Fees Calculator

Florida Income Tax Calculator Smartasset

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro